nh transfer tax calculator

The statute imposing the tax is found at RSA 78-B and NH Code of Administrative Rules Rev 800. Our calculator has recently been updated to include both the latest.

New Hampshire Property Tax Calculator Smartasset

14 Main Street 2nd Floor Newport NH 03773 Phone.

. FED OR DATE per S_55 per 500 per S 100 or fraction of S. From to transfer tax tax2 4001 4100 62 31 4101 4200 63 32 4201 4300 65 33 4301 4400 66 33 4401. If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767.

NH Real Estate Transfer Tax Rate Table Purchase price rounded up to the next 100 x 015 Tax is rounded up to the next dollar amount 40 minimum tax for purchase less than 4000. Payment of the RTF is a prerequisite for recording the deed and it should be noted that in addition to. The tax is assessed on both the buyer and seller upon the transfer sale or granting of real property or an interest in real property.

Click Here to Search. The New Hampshire real estate transfer tax is 075 per 100 of the full price of or consideration for the real estate purchases. You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202223.

Your average tax rate is 1198 and your. Enter your info to see your take home pay. The statute imposing the tax is found at RSA 78-B and NH Code of Administrative Rules Rev.

State with an average. SmartAssets New Hampshire paycheck calculator shows your hourly and salary income after federal state and local taxes. Lender Premium Reissue Owner Premium Closing Protection Letter 2500.

The current 2021 real estate tax rate for the Town of Londonderry NH is 1838 per 1000 of your propertys assessed value. 15 per 100 or fraction of S_2S per S 100 orfraction of S25 per 100 or fraction of paid by both Buyer. New hampshire real estate transfer tax calculator the state of nh imposes a.

The RETT is a tax on the sale granting and transfer of real property or an interest in real property. Transfer Tax Endorsements Loan Premium Owners Premium. The Real Estate Transfer Tax RETT was enacted in 1967.

Nh real estate transfer tax calculator. But while the state has no personal income tax and no sales tax it has the fourth-highest property tax rates of any US. New Hampshire is known as a low-tax state.

The statute imposing the tax is found at RSA 78-B and NH Code of Administrative Rules Rev 800. The tax is imposed on both the buyer and the seller at the rate of. Delaware DE Transfer Tax.

Monday Friday 800 AM 400 PM. Rate Calculator - NH. The State of Delaware transfer tax rate is 250.

New Hampshire Income Tax Calculator 2021. State Transfer Tax Rates. The assessed value multiplied by the real estate.

Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. The total transfer tax for NH is.

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Trash Talk The Brookline Transfer Station

New Jersey Nj Tax Rate H R Block

Tax Preparation Assistance Through Vita Franklin Nh

2022 Casella Sustainability Award Town Of Stratham Nh

New Hampshire Estate Tax Everything You Need To Know Smartasset

Dmv Fees By State Usa Manual Car Registration Calculator

Best Homeowners Insurance In New Hampshire 2022 Forbes Advisor

Transfer Tax Calculator 2022 For All 50 States

Sales Taxes In The United States Wikipedia

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Resources For Real Estate Professionals Red Door Title

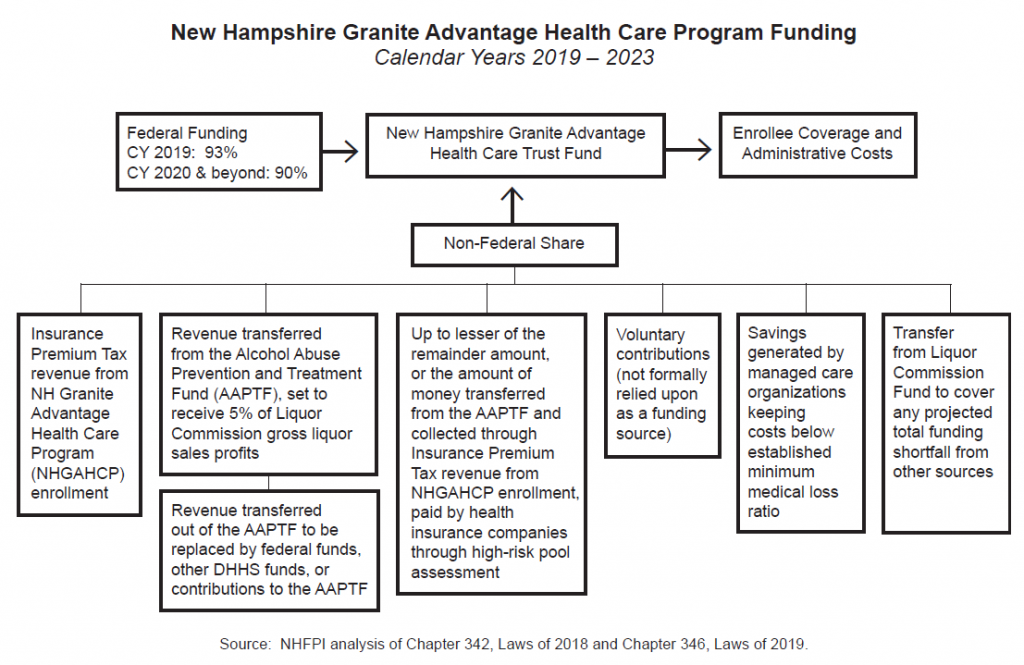

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute